The Denver International Airport’s concessions scene – including its food, beverage, retail and entertainment operators – is evolving to accommodate more visitors and changing consumer habits. In the immediate future, travelers should expect to see tenant changes in existing space as leases expire and new tenants move in, and they can expect to see their retail options increase exponentially in the next three to four years, as all three concourses open expansions and the Great Hall project finishes.

As of December, the airport had 190,000 square feet of concession space with 143 operators. In total, these operators did $380 million in gross sales in 2017, which equates to roughly $1,922 sales per sf, or $12.02 sales per enplaned passenger, according to DIA. Passenger traffic was up 8 percent in 2016 and a little over 5 percent in 2017, reaching 61.4 million passengers last year.

Like any retail business, with success comes growing pains and challenges with existing space. These next few years – as have been the past few – will be about accommodating that growth, said Patrick Heck, DIA’s chief commercial officer and executive vice president.

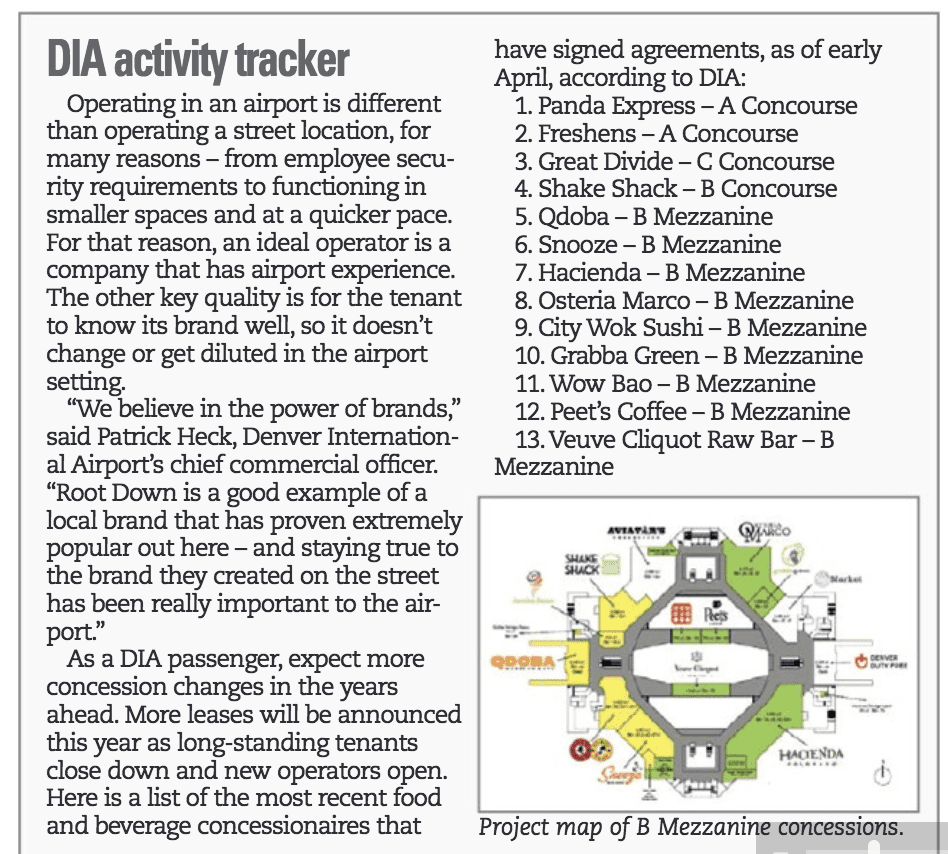

At the moment, most of the lease announcements are the result of turnover from previous operators, including some expiring agreements that date back to the airport opening in 1995. The new concepts will offer a “refreshed” experience, Heck said. For example, on the B Mezzanine, Woody Creek Bakery and Wolfgang Puck will close and Snooze, Shake Shack and Hacienda Colorado will open. However, when the Great Hall project is completed and the concourse expansions open, there will be quite a bit of new space.

“I’m going to guess in the neighborhood of 80,000 to 100,000 square feet that’s all new space,” Heck said. “So, for the next three or four years, it’s going to be a fairly hefty combination of both new space and turnover of existing space.”

According to Heck, the retail real estate at DIA has three goals:

• Meet the specific needs of travelers,

• Surprise and delight travelers with unexpected or unique options, and

• Generate critical nonairline revenue to help keep the airport’s costs low for airlines.

Meeting the specific needs of travelers differs across the globe. In general, the most successful airports have a strong understanding of who their consumers are. For example, some of the most successful Asian airports focus on high-end retail, while some of Europe’s busiest airports dedicate a great deal of space to duty free. The common denominator among these airports is that they each do a great job of meeting their customers’ needs and wants. With that goal in mind, almost 70 percent of DIA’s concessions square footage is dedicated to food and beverage – because that’s what U.S. customers have responded well to, Heck said.

“We want our airport to reflect the region it serves,” he said. So, there’s an emphasis of Colorado- and Denver based restaurants, everything from Root Down and Elway’s to Smashburger and Snooze. “It gives us a way to showcase our region” and hopefully entice those connecting here to plan a future trip to Colorado, he said.