The collapse of the housing bubble in 2007 affected single- and multifamily building. Now that we’re almost 10 years past the problem, we see the multifamily market bouncing back strongly while single-family housing has yet to fully recover.

There are several factors that we see driving strong growth for apartment occupancy, rents and, ultimately, values. Fortunately for apartments, single-family housing for entry-level buyers is stuck in low gear. This creates a wonderful tailwind for apartment owners.

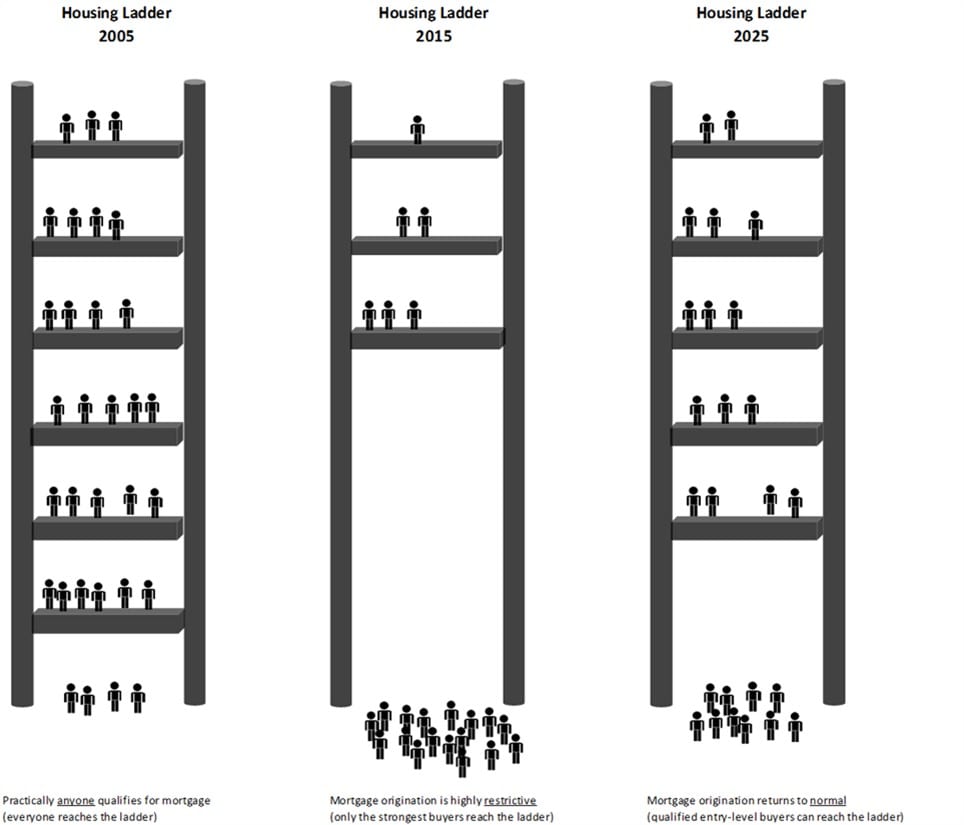

Why? Mortgage lending for entry-level housing still is quite restricted following the collapse of housing. Entry-level buyers tend to be younger and less well-established economically. Additionally, they are more likely to have large student loans outstanding and their credit scores are lower. Also, their wages tend to be lower. Finally, it is likely they do not have sufficient savings to come up with the higher down payments required by banks. Mortgage qualification has been restricted and many would-be buyers cannot get on the housing ladder.

As a result, potential entry-level buyers are flocking to apartments or sharing accommodations with one or more people.

Additionally, many millennials prefer to live in or near urban areas and, given their economic situation, they are far more likely to be renters than owners.

Finally, single-family housing supply considerably lags its long-term average, particularly in the entry-level market. Homebuilders are focused on the higher-priced single-family homes where demand is greater and mortgages are available. Single-family houses are expensive to build, hampered by trades and suppliers struggling to recover from the housing collapse. Municipalities also are struggling to keep up with permit demand and approvals. We believe that entry-level housing will take five to 10 years to fully normalize in Colorado and most other markets.

All of the above explains the Denver multifamily property values continuing their current inexorable climb. Simply put, apartment permits are well above the norm – recently averaging 9,500 per year versus the long-term demand of 5,500 units per year. The overbuilding in apartments is being (temporarily) absorbed by millennials who are forced to defer their entry-level home purchase.

However, we expect this artificial demand to reverse within the next two to five years as the millennials gain increasing access to mortgage financing. In the meantime, for the next two to three years, apartment developers will enjoy an Indian Summer that they will later come to regret. The fact is, Denver apartment deliveries are continuing well above trend – some analysts are projecting nearly 10,000 new units per year for the next two years.

In our shop, we believe that there is considerable risk of continued overbuilding in the next two years. This is reflected in the graph below in which the red bars represent known projects built or underway and the yellow bars represent deals in the pipeline that might, unfortunately, be built. The real key to the potential downturn will be found in overbuilding.

Unfortunately, the great return recently enjoyed by apartment developers and buyers has created a sense of complacency. Capital is abundant and it is likely to drive more serious overbuilding. The future still remains in our hands. That is, if developers stop building, the negative downturn is likely to be modest. Unfortunately – given the nature of developers – this is possible, but not likely.

The larger the oversupply, the worse the subsequent correction.

What these graphs do not take into account is a recession. It is our estimate that there will probably be a recession in 2019 – give or take one or two years. While this recession likely will be a garden-variety recession, it will have devastating consequences on apartments because it is likely to appear precisely at the time of peak overbuilding of apartments. Vacancies will spike, rents will plummet and values will decline.

We are calling this unfortunate confluence a “negative trifecta” for apartments based on:

- Multiyear overbuilding above population demand.

- Millennials finally converting from renters to homeowners.

- A future recession.

In real estate, timing is everything. We believe that apartments currently are enjoying an Indian Summer. But Denver is getting close to the end of good times for apartments as the Real Capital Solutions’ investment clock illustrates.

Based on our track record of calling real estate cycles, some have credited us with an “experienced gut feeling” for where the markets are heading. We are, in fact, guided by defined metrics, allowing us to predict with considerable accuracy the coming cycle downturn. The combination of higher vacancy and lower rents stresses apartment cash flows breaching construction loan covenants. It is the appearance of distressed sales that causes a severe downturn in apartment values. We are not sure that such a downturn will occur in Denver, but we are watching the metrics carefully.

We are continuing to build selectively. We still like the transit-oriented and the senior-oriented apartment market niches. Otherwise, in Colorado, we have taken the precaution to sell our three other apartment projects.