Northern CO needs new water market benchmarks

The Northern Colorado water market, extending along the Front Range from Denver north to the Wyoming border, is one of the most active water markets in the western U.S. This market annually sees over $60 million in water sales, fueled by one of the hottest housing markets in the country. The market also is fueled by competition. Unlike some other fast-growing areas in the western U.S., there is no regional water provider for growing cities and towns to access. Instead, cities, towns and municipal water districts compete for water assets as they each plan and assemble individual water rights portfolios.

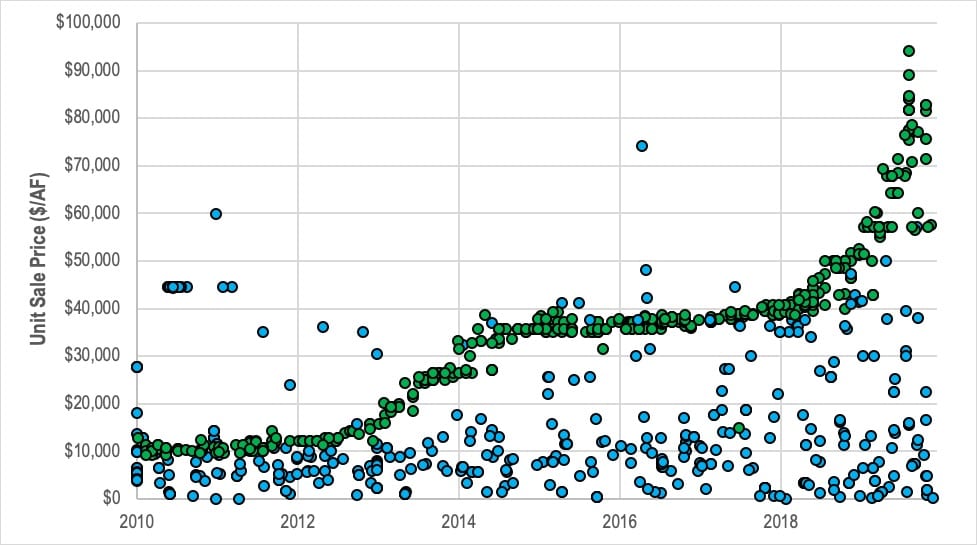

The benchmark for pricing high-value water assets that are used by the municipal sector has long been sale prices of contract units in the Colorado-Big Thompson Project. The CBT Project is a U.S. Bureau of Reclamation project constructed from the 1930s to the 1950s that diverts water from the headwaters of the Colorado River and conveys it through a transbasin tunnel to the Front Range for storage in Horsetooth Reservoir and Carter Lake. The CBT Project supplies represent a high-quality, reliable and therefore desirable water asset for northern Front Range municipalities. Many municipal water providers have relied upon CBT Project water supplies as a sole source of supply for decades.

The CBT Project established 310,000 contract units (akin to equal shares) for annual use of the project water supply. Originally, about 80% of these CBT units were owned and used in Front Range agriculture. Over time, with population growth along the Front Range and a corresponding need for additional municipal water supplies, the CBT units have experienced a large-scale transfer in ownership, such that only about 10% of the units are held by individual irrigators and considered available for sale. These CBT units have changed ownership through market trades and the CBT market has been consistently pointed to as one of the best examples of a pure and well-functioning water market in the western U.S.

The CBT water market has become a benchmark because it has been an active market for one of the most desired water right assets. As a benchmark, many municipal water providers have set their cash-in-lieu (of water dedication) rates based on current CBT pricing, reflecting the long-standing process of a municipality using the cash received from a developer to purchase CBT units. Many high-value ditch company shares also are priced relative to CBT units. For the last 20 years (or more), the CBT market has been the best index with which to gauge the value of many different water assets and it has directly influenced the water costs of development in Northern Colorado.

As a result of its high demand and dwindling supply, CBT market prices recently have risen to nationally record-setting prices. CBT units currently are trading at about $60,000 per unit, which is equivalent to about $85,000 per acre-foot of average water yield. Applying this current CBT market price to a fairly typical water dedication requirement of 0.5 acre-feet per new home, the water right costs alone represent $42,500 per home, or a monthly cost of $200 under a 30-year mortgage at 4% interest. Many developers do not think that they can create a competitive housing product at these water prices.

In response to high prices and limited remaining supply, the volume of CBT trades recently has declined. CBT units will continue to be desirable assets with transfers to municipal use, but the pricing is likely to continue to diverge from the costs of alternative water sources and from being affordable for new development. In short, CBT prices are becoming less relevant as the remaining inventory winds down.

As a result, the Northern Colorado water market is starting to find itself without a benchmark to make planning and policy decisions around water pricing, a situation that has not occurred for 20 years or more. Instead of CBT units, future growth is likely to rely upon a combination of large regional water supply projects and continued acquisition of ditch company shares. New and innovative water sharing and exchange projects also may come to fruition. A variety of new creative efforts are needed to meet projected demands.

I can’t provide a silver bullet as to what the new benchmark should be, in part because there may not be a single benchmark that applies across the Northern Colorado region. The CBT Project was a unique resource for Northern Colorado and the closest replacements we have are the pending Windy Gap Firming and Northern Integrated Supply projects. It’s likely that each municipal water provider will need to craft a unique plan for how to handle the next 20 years in terms of water supply, which hopefully will influence water pricing for new development within individual service areas. The convenience of a regional water market benchmark has been nice, but it’s not likely to last much longer.

Featured in the September 2-15, 2020, issue of CREJ