As we enter 2020 in the longest bull market run since World War II, there is little question we have entered uncharted waters in the investment landscape, particularly for those of us in the multihousing space. The tidal wave of capital chasing deals in Denver is unprecedented, a trend mirrored in many other desirable metro areas nationally. We hear the term “buyer fatigue” over and over, as investors find themselves stretching their underwriting and pushing pricing to new thresholds, only to get beaten out during multiple rounds of bidding.

Immense competition has pushed pricing for multihousing assets in Denver to an all-time high of $260,709 per unit in 2019, while average cap rates compressed another 17 basis points from 2018 to 4.68%. Current market conditions have led many investors to rethink their investment strategies as they try to make sense of the current market while weighing the need to deploy capital – we’ve seen everything from smaller, value-add syndicators aggressively targeting core and core-plus opportunities to move up the quality curve to global institutional investors acquiring 1990s-vintage deals in core funds. All of this is great news for sellers but has made buying in Denver increasingly difficult.

These trends are not unique to Denver by any means. Looking at the sales volume of the top 20 metro areas, 11 markets saw notable decreases in investment sales since 2018 with an average 20% decrease. While some of this decline can be attributed to public policy uncertainty (think rent control in New York and California, and adverse taxation in Chicago land), much can be ascribed to elevated pricing making it challenging for investors to realize adequate risk-adjusted returns. As the cap rate spread between primary and secondary markets has narrowed close to an all-time low, investors increasingly are targeting smaller secondary and “tertiary” markets where competition tends to be lower to meet their return hurdles. Tertiary markets commanded an all-time high 26.2% of total multihousing market share in 2019. These markets, on average, offer cap rates 119 basis points above major metro areas and 54 basis points above secondary markets, which, paired with cheap debt, has caught the interest of investors across the spectrum.

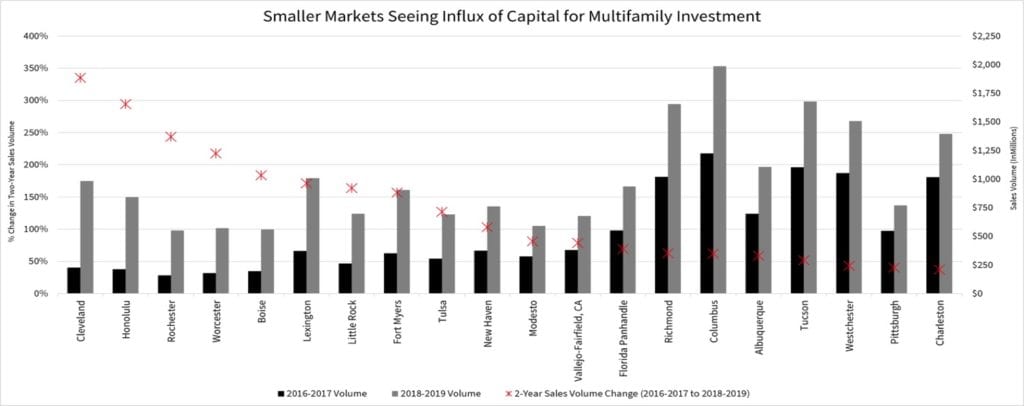

To demonstrate this point, we analyzed Real Capital Analytics sales data for smaller multifamily markets (2018-2019 sales volume $500 million to $1.5 billion) nationally looking at growth in two-year sales volume from 2016 to 2019. The 20 markets that experienced the largest increase in sales volume have, by and large, been overlooked by institutional investors this cycle. However, some of these markets (such as Boise, Idaho; Fort Myers, Florida; Charleston, South Carolina; and Columbus, Ohio) have seen growing interest over the last two years due to strong employment growth and millennial in-migration, while markets like Cleveland; Richmond, Virginia; and Pittsburgh, slow to recover from the recession, are in the midst of transformative downtown revitalizations buoying renter demand.

Across these 20 markets, the average sale price over the last two years was $118,819 per unit, 26% below the national average of $160,148. Another common theme across these markets is their relative affordability. With ample job opportunities available and the growth of telecommuting (up 159% since 2005), smaller metro areas have become magnets for millennials, particularly those offering an attractive quality of life and revitalizing urban cores. In fact, ULI’s Emerging Trends in Real Estate 2020 noted several of these 20 metro areas as “treasures ripe for discovery,” while several institutional groups have raised funds specifically targeted at secondary and tertiary markets.

What does this mean for us here in Colorado? Likely more of the same in the Denver and Boulder metropolitan statistical areas. The market continues to exhibit some of the strongest multifamily fundamentals in the country – annual job growth of circa 40,000, more than 5% wage growth, relatively affordable rents (23% of median income) – which should sustain competition for multifamily assets even in a low cap rate environment. According to RCA data, private investors comprised 56.6% of multifamily acquisitions in Denver in 2018, falling to 38.3% in 2019. Private investors and syndicators are finding it challenging to compete with institutional investors in Denver whom have a lower cost of capital and lower yield thresholds.

As competition and diminishing returns cause investors to look outside Denver, Colorado’s own “tertiary” markets are primed to benefit from new capital. For example, the largest of these markets – Colorado Springs – has seen some of the strongest rent growth in the country, which has increased by an annual rate of 6.3% over the last three years. The metro area added more than 52,000 new residents over this time period, with net migration accounting for 64% of growth, while employment has grown by nearly 14% with the addition of over 32,000 new jobs. These dynamic fundamentals have ushered in a new era of investment interest in the 714,000-person MSA, fostering a 9.8% average sale price per unit in 2019. Perhaps most compelling is that while Colorado Springs is just 40 minutes south of metro Denver, the 2019 average cap rate of 5.33% is 65 basis points higher than Denver.

Colorado Springs shares a similar story with many of the tertiary markets mentioned previously: a rapidly diversifying economy, a catalytic urban renaissance with the addition of two new sports and entertainment venues and a renowned quality of life. When coupled with a remarkably well educated population (41.8% of Springs residents have a bachelor’s degree) and a dramatically increasing millennial population (the highest in the country, according to a 2018 Brookings study), it is no wonder why the area is drawing increased attention from investors.

While we focus on Colorado Springs in this article, many of Colorado’s other tertiary markets exhibit similar attributes and should bode well for investors looking for yield in new frontiers. The Fort Collins MSA boasts a cap rate discount of approximately 50 basis points relative to Denver, and as Greeley’s population and employment base continues to increase at a break-neck pace, we anticipate increased activity there as well.

These trends sound awfully familiar to those we experienced in Denver back in the good old days of 2015 and 2016 when investors balked at cap rates in the mid-5% range and prices in the low $200,000s per unit. As legitimate five caps have become somewhat of a proverbial “white whale” in Denver, it is worth giving tertiary markets like Colorado Springs and others across Colorado the deep dive they deserve.

PRIMARY, SECONDARY & TERTIARY: DEFINED

Market classifications for the purpose of this article are based on Real Capital Analytics’ definitions of “primary/major metros,” “secondary/ nonmajor metros” and “tertiary.”

Primary/major metros: A descriptor referring to the six largest metro markets in the United States – Boston, Chicago, Washington, D.C., Los Angeles metro, New York City metro and San Francisco metro.

Secondary metros: A descriptor referring to markets in the U.S. that are secondary to the major metros. Secondary markets include Atlanta; Austin, Texas; Baltimore; Charlotte, North Carolina; Cincinnati; Cleveland; Columbus, Ohio; Dallas; Denver; Detroit; Houston; Indianapolis; Jacksonville, Florida; Kansas City, Missouri; Las Vegas; Memphis, Tennessee; Milwaukee; Minneapolis; Nashville, Tennessee; Norfolk, Virginia; Orlando, Florida; Philadelphia metro; Phoenix; Pittsburgh; Portland, Oregon; Raleigh/Durham, North Carolina; Sacramento, California; Salt Lake City; San Antonio; San Diego; Seattle; South Florida; St. Louis; and Tampa, Florida.

Tertiary markets: All other U.S. states not included in major metros and secondary markets.