While The Fresh Market’s closure of 15 stores in July had a minimal impact on the commercial real estate landscape, the upscale grocer’s pullback may suggest additional challenges in the grocery industry. The company, which was acquired by a private equity firm in 2016, has had two major closures amounting to about 13.4 percent of its store count. In the case of The Fresh Market, which had no stores in Colorado, ongoing competition from Whole Foods Market and Trader Joe’s, as well as a lack of scale, may have contributed to the company’s decision to withdraw to its more traditional markets in the southeastern United States.

Colorado has been fortunate to have avoided the mass grocery closures that have affected other states. In 2015, Safeway announced that it would close nine stores in the Denver area; however, closures since that time have been isolated, even as SuperValu shuttered 16 Shop ‘n Save stores in St. Louis or Southeastern Grocers closed more than 94 stores across seven states in 2018. Employment growth in Colorado has been stable to improving since the rebound in the oil and gas industry. Job growth in the state for 2018 is expected to exceed the initial projections by nearly 15,000 jobs, according to the Business Research Division at the University of Colorado’s Leeds School of Business.

One significant event in the grocery industry since The Fresh Market went private was Whole Foods’ 2017 acquisition by Amazon.com Inc. While the full effect of Amazon’s entry into the grocery business has yet to be felt, some of its early moves could negatively affect smaller chains in the fresh-food space. Whole Foods, which had prices that were 15 percent higher than traditional grocers, according to Morgan Stanley, has embarked on a series of price reductions, most notably in 2018 when it began offering specials to Amazon Prime members. In addition, Whole Foods, using the Amazon Prime Now platform, began home delivery of groceries in 2017, with expansions to new cities in 2018. Of the 15 Fresh Market stores that closed, DBRS identified six that were within 6 miles of a Whole Foods store and one that was within 6 miles of a Trader Joe’s, factors that may have played a role in the stores’ underperformance.

Over the next several years, we expect Amazon to use its strength in logistics, as well as its advanced use of customer data, to continue changing how customers shop for groceries. Large chains like Walmart and Kroger, which has a significant presence in Colorado under its King Soopers banner, may be able to maintain a price advantage over Whole Foods thanks to their scale and investment in their logistics operations. In addition, moves by traditional chains into the organic and fresh-food space may produce higher margins over time.

As the evolution of the grocery business continues, smaller chains like The Fresh Market may lack the scale necessary to achieve pricing power over its suppliers. Additionally, the company’s infrastructure may not allow it to compete effectively in the delivery space without a significant capital investment. Also, with Sprouts Farmers Market expanding to nearly 300 stores, according to an April Supermarket News report, there is a new aggressive competitor lurking. The Fresh Market, which brands itself as a more intimate, local store offering high levels of service, could find itself relegated to a more regional, niche player in the industry.

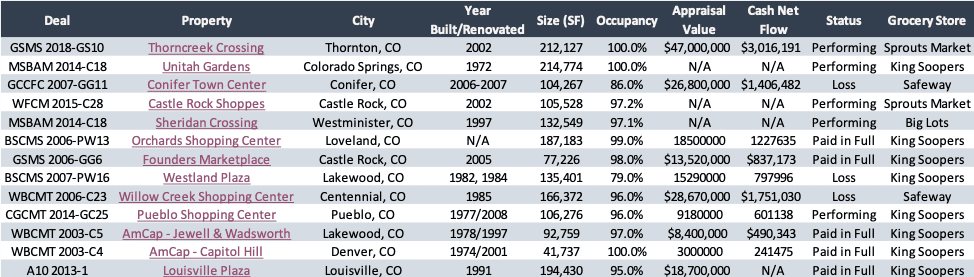

In the DBRS Viewpoint database, analysts found 13 grocery-anchored properties (refer to in the chart) across Colorado; 38.5 percent belonged to performing loans, an additional 38.5 percent were included in “paid in full” loans and only 23.1 percent were in loans operating at a loss. This shows that Colorado’s grocery-anchored properties are performing well as far as structured loans go. However, 71.4 percent of the active loans are facing a declining net cash flow, which may hint at some trouble in the future.

For real estate investors, the positive news is that upscale, specialty grocers like The Fresh Market tend to have smaller spaces, ranging from 20,000 square feet to 30,000 sf, compared with traditional grocery stores’ more than 50,000 sf. This may make it easier to backfill the space without having to incur the cost to demise or reconfigure the space. In addition, upscale chains like The Fresh Market tend to lease space in more affluent areas, which also may make backfilling those vacant spaces easier. Despite headwinds, there may be little risk of spoilage from smaller chains like The Fresh Market.