Investor sentiment remains strong despite hurdles

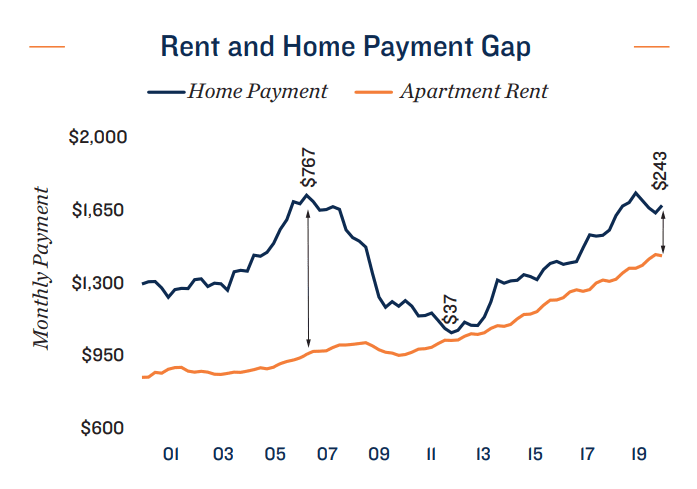

Multifamily housing performed exceptionally well over the course of this cycle, driven by the affordability of renting an apartment relative to owning a single-family house, and the younger generations’ preference for leases and added amenities. Over the past few years, workforce rentals became increasingly undersupplied, as vacancy was near 20-year lows ending 2019. As such, investors predict only a temporary pause in demand for multifamily housing as a result of COVID-19.

Survey responses suggest that we’ll see a short-term decline in investor demand for assets; those responses also highlighted the longterm positive outlook for investing in multifamily properties once the crisis subsides. Many investors, such as Craig Kalman, investment director at RedPeak Properties, do not believe there will be a decrease in investor demand for multifamily assets in the long run.

“We feel fortunate to be in both the multifamily sector and the Denver market,” wrote Kalman. “Once this pandemic pass, we believe that Denver will continue to outperform the broader market. The record amounts of capital that were pursuing multifamily before this crisis will still be out there looking for strategic assets.”

Despite strong long-term fundamentals, multifamily owners undoubtedly will have hurdles to overcome. With today’s added uncertainty, property finances should be closely monitored and managed, as a reduction in rental income is entirely possible while expenses may arise concurrently. COVID-19 did not appear to have an immediate effect on rent growth; however, the volume of moves likely will slow significantly in the coming months due to the unemployment, eviction moratoriums and general uncertainty. Consequently, owners are taking additional steps to retain tenants to protect the bottom line.

Flexible payment options have been an excellent strategy to provide not only financial relief for residents but also create a pathway for them to stay in their homes. In a statement regarding the programs they have implemented to help minimize the payment burdens for their tenants, one local management company is offering “a rent payment plan to residents who can demonstrate they have lost their jobs or have had their income significantly reduced. Qualified residents will be allowed to defer 66% of their April rent and pay the remaining balance in agreed-upon installments over the next two months.”

Owners are taking a conservative approach regarding expenses, as well. This same group stated that, “Maintenance is emergency only right now, which should help reduce expenses in the short term [and] we are pushing all property tax payments back to the extended deadline.”

Maintaining healthy cash positions is one of the main objectives in preparation for a potential prolonged economic pause. Hugo Weinberger, president at The Situs Group, said his company is, “Focused on maximizing cash flow through rent collection policies and expense controls. [We are] evaluating capital expenditures with a focus on completing only necessary projects due to residents seeking affordability over renovated units.”

Investors have acknowledged that there will continue to be some operational challenges, but also see the strength and stability in the demand from in-place residents and in the likelihood of newly formed households in this crisis choosing affordable rental options to meet their current housing needs.

Looking at rents and vacancies over the next six months, some investors currently believe that rents will decline slightly, and vacancy rates will rise slightly, which will alter the valuation process. Craig Lessard, director of acquisitions at WoodSpear Properties, said that his firm remains interested in acquisitions but is struggling to appropriately price assets in the current environment.

“Sellers want yesterday’s pricing, which reflects tight vacancy and 3% or 4% rent growth,” he said. “In the short term, it looks like the vacancy will be slightly higher, and rent growth will be zero. I think a pricing gap will present itself and will work itself out over the next three to six months.”

Additionally, the credit supply to owners and investors has contracted, which further alters underwriting standards. Those lenders who are open for business continue to provide capital but are seeking credit enhancements, including lower loan-to-value ratios and higher spreads. With that said, “In the last two weeks, we were able to execute on a refinance at very attractive terms,” Kalman said. “For the right asset and borrower, debt liquidity is still strong.”

Despite the next hurdle investors face, multifamily remains a secure commercial real estate investment. Several factors support an optimistic viewpoint. The underlying trends that have supported apartments throughout this cycle continue to be in place and will sustain robust demand for rentals in the long term. One of the fundamental principles of driving multifamily housing is that people always will need a place to live. The global pandemic will not push prospective renters toward single-family house purchases as an alternative as the rent to home payment gap remains significant.

Featured in CREJ’s May 2020 Multifamily Properties Quarterly