Retail lending in 2019 is anticipated to increase compared to last year as lenders and equity investors continue to get more comfortable with how the evolution of omnichannel retail sales impacts bricks-and-mortar real estate. Lenders have been cautious since the overreaction to Amazon acquiring Whole Foods in mid-2017 and the herd focused on financing other property types as many were already overallocated in retail. Retail investors had concerns about internet sales continuing to take sales away from retail stores, but retailers continued to expand into omnichannel sales, which absorbed space and created new uses. Value-add investors have proven to lenders that big-box retail in the right location can be repurposed into uses as diverse as creative offices, climbing gyms, car dealerships and discount health clubs.

Following is a general summary of preferred property types, from best to worst, and what to expect with financing terms.

- Grocery-anchored shopping centers in Class A locations with a top-two grocer.

- Class A malls and Class A power centers with quality credit tenants.

- Well-located neighborhood retail centers in strong demographic areas occupied by internet-resistant tenants that serve the neighborhood.

- New retail developments with a heavy concentration of restaurants in Class A locations or concepts, like covered markets where 20 kiosk quick-serve restaurants offer healthier food options (compared to fast food).

- Ethnic grocery-anchored centers.

- Class B power centers.

- Class B malls.

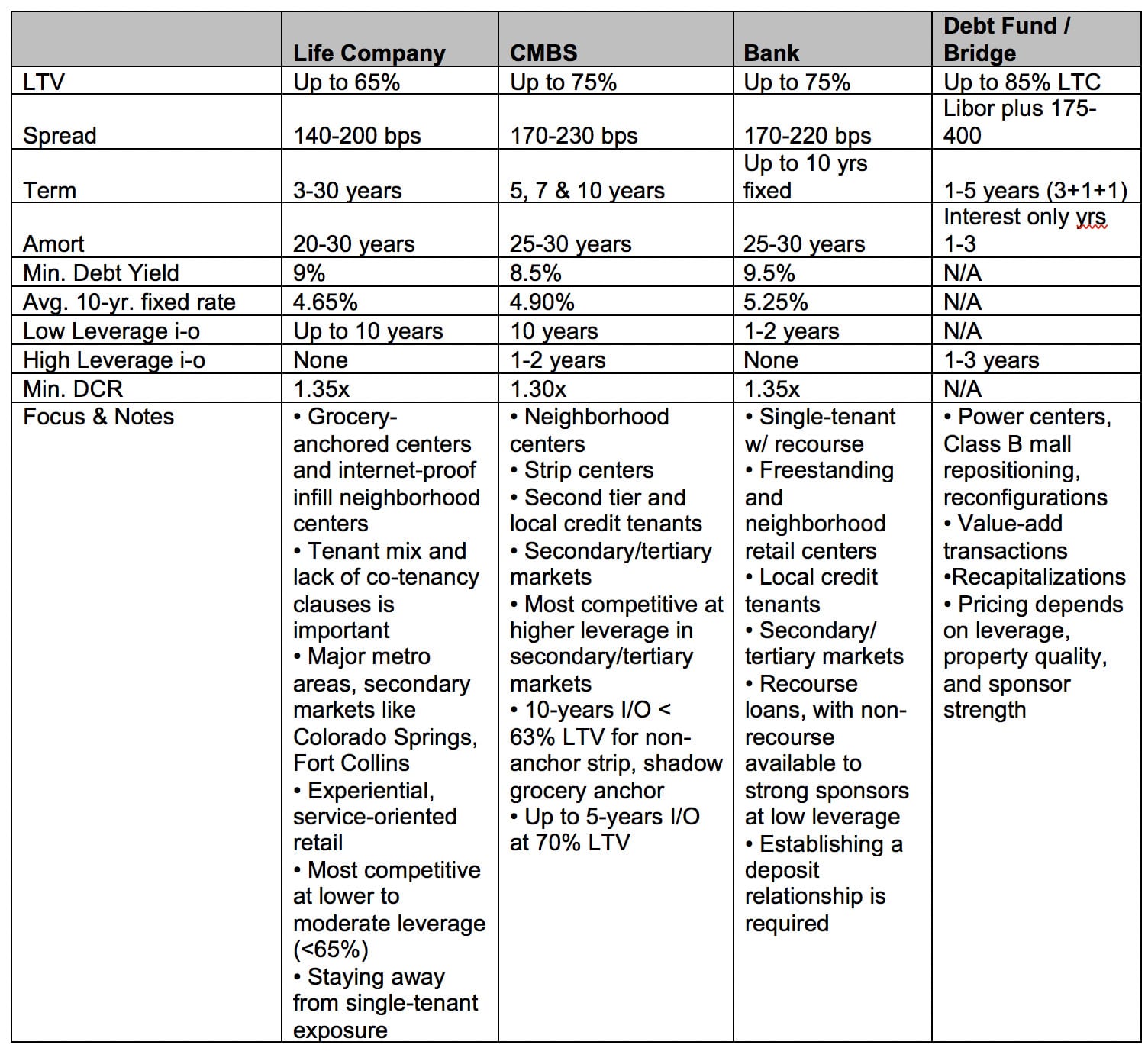

At 65 percent loan to value or less, insurance companies will provide the lowest fixed and floating rates for the top four property types, followed by banks for shorter-term loans less than five years. The threshold for nonrecourse with a bank is approximately 60 percent on stabilized properties with quality tenants. Commercial mortgage-backed securities lenders offer the combination of highest proceeds and interest only up to 65 percent for full term interest only and 75 percent LTV with no interest only.

Debt funds are financing Class B power centers and malls but the investor must have a viable redevelopment plan versus a cash flow play at a high cap rate. These properties typically have failing or poorly performing anchors like Sears, Macy’s or J.C. Penny. The major tenants may own their building or the remaining lease term is too long for redevelopment potential. Class B big-box power centers usually have at least one tenant struggling with more than 20 percent of the total rentable area. CMBS lenders, debt funds and banks are the best lending sources for these types of properties.

Twenty years ago, retail properties with a health club or a high concentration of restaurants were some of the most challenging to finance. Internet-resistant tenants like this are now attributes. Some strong health clubs with high membership rates draw more shoppers on a weekly basis compared to a top-three market share grocery anchor. The omnichannel retailers have proven there will likely always be a need for bricks-and-mortar retail. The lack of new retail construction in this cycle also has kept vacancy rates down. The combination of evolving omnichannel marketing, new concepts and the lack of new retail construction nationwide are anticipated to continue and create more financing demand for retail properties throughout the year.